Industrial Sensor Procurement Guide: Sourcing PCB Components & Solving Shortages

As industries move toward Industry 4.0 and the Internet of Things (IoT), the demand for data collection has exploded. Every device, from automotive control units to smart home thermostats, requires precise detection capabilities. However, this surge in demand has collided with global supply chain instabilities, creating a complex environment for anyone trying to buy industrial sensors.

For procurement professionals holding a Bill of Materials (BOM), the challenge is twofold. First, you must secure high-quality PCB mount sensors that fit precise engineering specifications. Second, you must navigate a market plagued by allocation issues and discontinued parts.

Understanding the Landscape of Industrial Sensors

Before we discuss procurement strategies, we must categorize what we are buying. In the B2B context, "sensor" is too broad a term. To secure the right stock, we need to focus on the specific variants used in circuit design, primarily PCB mount sensors.

Unlike large, external sensors used in heavy machinery, PCB mount sensors are soldered directly onto the printed circuit board. They are the heartbeat of modern electronics.

The Critical Role of PCB Mount Sensors

These components are often compact, sensitive, and highly specific in terms of packaging (SMD vs. Through-hole).

Pressure Sensors: Used in medical ventilators and industrial pneumatics.

Temperature and Humidity Sensors: Critical for environmental monitoring systems.

Motion and MEMS Sensors: Essential for robotics and automotive stability control.

When you are tasked with industrial sensor procurement, you are often looking for parts that must withstand harsh environments while maintaining high precision. The reliability of the component dictates the reliability of the final product.

However, the specificity of these parts is what makes them difficult to source. A slight difference in the footprint or digital interface (I2C vs. SPI) can mean a part is not compatible with your board design. This is why having access to a massive inventory of sensors is not just a luxury; it is a necessity for maintaining production schedules.

Navigating the Sensor Chip Shortage

The term "sensor chip shortage" has become a permanent fixture in our industry's vocabulary. While the media often focuses on consumer electronics, the impact on the industrial sector is far more severe.

Why are sensors harder to find than other components?

Complexity of Manufacturing: MEMS (Micro-Electro-Mechanical Systems) sensors require specialized fabrication processes that are different from standard logic chips. Scaling up production takes years, not months.

Legacy Technology: Many industrial designs rely on older sensor nodes that major manufacturers are phasing out in favor of newer, smaller chips.

High Mix, Low Volume: Unlike smartphones, industrial equipment often requires high-mix, low-volume orders, which receive lower priority from direct manufacturers during allocation periods.

Real-World Sensor Chip Shortage Solutions

When you face a 50-week lead time, you cannot simply wait. You need proactive sensor chip shortage solutions.

Broaden Your Supply Network: Do not rely solely on franchised distributors. You need independent partners who have visibility into global stock movements.

Design for Flexibility: Encourage engineering teams to design boards that can accept multiple sensor footprints.

Strategic Stockpiling: When you find a sensor electronic components distributor with stock, do not buy just for today. Buy for the next three quarters.

At Joydo Distributors, we have positioned ourselves to help clients navigate these exact challenges. By aggregating stock from across the global market, we provide a buffer against the volatility of the primary supply chain.

The Hidden Value of Obsolete Component Suppliers

One of the most stressful situations for a buyer is seeing the letters "EOL" (End of Life) next to a critical sensor on the BOM. Redesigning a circuit board to accommodate a new sensor is expensive and time-consuming, often requiring new certifications.

This is where the secondary market becomes invaluable. You need a reliable obsolete sensor components supplier.

Contrary to popular belief, "obsolete" does not mean "unavailable." It simply means the original manufacturer has stopped producing new wafers. However, millions of these components still exist in the supply chain—if you know where to look.

Why Buying Obsolete Sensors is a Viable Strategy:

Cost Avoidance: The premium paid for an obsolete sensor is often significantly lower than the cost of re-engineering an entire product.

Immediate Availability: These parts are already sitting on shelves, ready to ship.

Market Niche: There is less competition for these parts compared to the newest releases, provided you can verify their authenticity.

Finding a partner who specializes in these hard-to-find parts is a high-profit activity. It keeps your legacy lines running and your customers happy.

Example: "Consider the Omron D6T MEMS Thermal Sensors. While popular, certain specific package types are becoming harder to find. If your BOM lists the D6T-44L-06, you might face delays. We actively stock these legacy lines..."

If you see these on your BOM, you are likely facing significant lead times or obsolescence issues. Here is a breakdown of top legacy sensors we frequently help clients source:

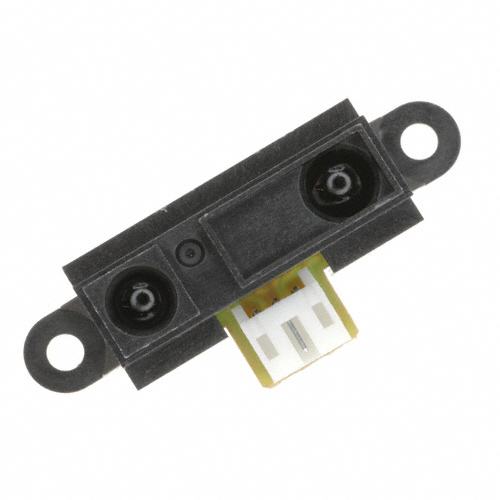

Sharp GP2Y Series (IR Distance Sensors)

Target Part Numbers: GP2Y0A02YK0F, GP2Y0A21YK0F

Original Application: These analog distance sensors were the gold standard for robotics obstacle avoidance, sanitary automation (automatic soap dispensers), and proximity switching.

The Procurement Challenge: Sharp has moved much of its focus toward smaller, digital Time-of-Flight (ToF) sensors. However, older industrial designs still rely on the specific voltage curve of these analog units. Redesigning the firmware to accept a digital I2C signal is often too costly for legacy products.

Status: High demand in the secondary market; often requires a specialized distributor to find authentic stock.

Omron D6T MEMS Thermal Sensors

Target Part Numbers: D6T-44L-06, D6T-8L-09

Original Application: Used extensively in building automation (HVAC) and factory safety monitoring to detect human presence via heat signatures without using a camera.

The Procurement Challenge: Omron continues to innovate rapidly in MEMS technology. While the series exists, specific Field of View (FOV) configurations often face long factory lead times or silent discontinuation as newer, higher-resolution versions are released.

Status: Specific older variants are becoming increasingly hard to find through franchised channels.

Honeywell CS Series (Current Sensors)

Target Part Numbers: CSLA1CD, CSLA2CD

Original Application: These through-hole, open-loop current sensors are legendary in industrial motor control and power supply protection circuits.

The Procurement Challenge: As power electronics move toward smaller, surface-mount (SMD) solutions, these bulky through-hole sensors are produced in smaller batches. Yet, for heavy industrial machinery that vibrates significantly, the ruggedness of these older packages is irreplaceable.

Status: Often subject to allocation; finding "New Old Stock" (NOS) is a common strategy here.

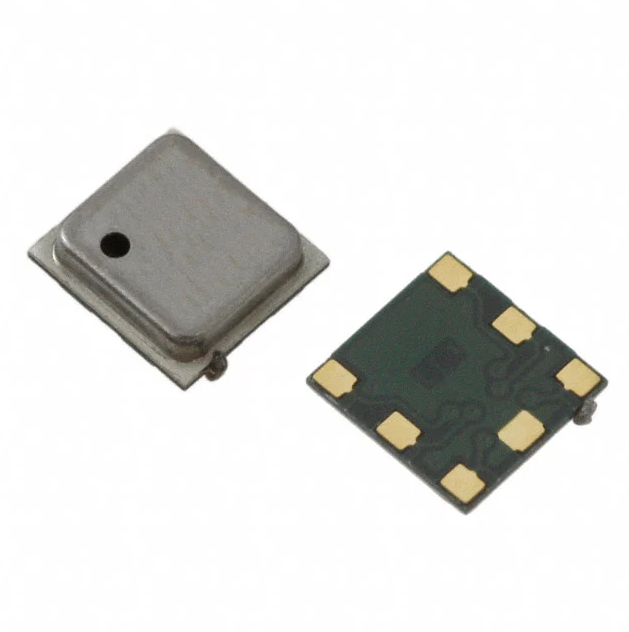

Bosch BMP180 (Digital Pressure Sensor)

Target Part Numbers: BMP180

Original Application: One of the pioneers of mobile weather sensing and altitude tracking for drones and handheld GPS devices.

The Procurement Challenge: Bosch has long since replaced this with the BMP280 and BMP390. The BMP180 is officially obsolete. However, thousands of legacy generic code libraries and older PCB designs still specify the BMP180 footprint. The pinouts are not directly compatible with the newer 280 series without a board redesign.

Status: Fully Obsolete. Requires a specialized obsolete component supplier to source remaining inventory.

Panasonic NaPiOn (AMN) Series (PIR Motion Sensors)

Target Part Numbers: AMN31111, AMN21111

Original Application: Small, low-power motion detection for security systems, lighting control, and smart thermostats.

The Procurement Challenge: While Panasonic still supports the line, they frequently prune specific lens types (e.g., specific detection distances or colors). A slight change in the lens specification can alter the detection zone, meaning you cannot simply swap one AMN sensor for another.

Status: Active but prone to specific SKU shortages.

Procurement Strategy – Buying Specific Brands Online

Effective industrial sensor procurement often comes down to brand specificity. Engineers rarely specify "a generic pressure sensor." They specify a "Bosch BMP series" or a "Honeywell HSC series."

As a buyer, your search strategy must match this specificity. Generic searches yield generic results. Specific searches lead to transactional success.

Case Study: How to Buy Bosch MEMS Sensors Online

Let’s look at a common scenario. Your BOM calls for a high-performance barometric pressure sensor. The engineer has specified Bosch due to their leadership in MEMS technology.

When you search to buy Bosch MEMS sensors online, you should look for specific indicators of a quality distributor:

Lot Traceability: Can the distributor tell you where the parts came from?

Date Codes: Are the parts factory new, or are they aged inventory?

Technical Data: Does the site provide the datasheet to confirm it matches your PCB footprint?

The ability to source specific brands like Bosch, STMicroelectronics, or TE Connectivity distinguishes a professional distributor from a generalist. At Joydo Distributors, we catalog our inventory by manufacturer and series, making it easy for procurement teams to filter by the exact specifications they need.

Example: "Bosch BME280 vs. BMP280. The BME280 measures pressure, humidity, and temperature, making it ideal for HVAC. The BMP280 focuses solely on pressure and temperature, offering a lower cost for altimeter applications..."

Here is how the market leaders stack up in three critical sectors: Automotive, Industrial IoT, and Medical Precision.

Automotive & Heavy Industrial: NXP vs. Infineon

In the realm of electric vehicles (EVs) and heavy industrial robotics, reliability at high temperatures is non-negotiable. Both NXP and Infineon are titans here, particularly for PCB mount magnetic sensors used in motor position control.

NXP Semiconductors (KMA Series)

Focus: Magnetoresistive (AMR/GMR) sensors. Known for extreme robustness in dirty environments.

Key Spec - Temp Range: Up to +170°C (ideal for under-hood applications).

Supply Voltage: Typically 5V or 12V compliant.

Procurement Note: NXP parts often have shorter lead times but stricter allocation rules during shortages.

Infineon Technologies (XENSIV™ TLE Series)

Focus: Hall Effect and GMR sensors. Famous for their functional safety (ISO 26262) compliance.

Key Spec - Temp Range: -40°C to +150°C (Automotive Grade 1).

Interface: Supports latest SENT (Single Edge Nibble Transmission) protocols.

Procurement Note: Infineon sensors are highly sought after for German automotive designs, often making them harder to find on the spot market without a specialized distributor like Joydo.

Bosch Sensortec vs. STMicroelectronics

The Battle for Low-Power MEMS IMUs (Inertial Measurement Units)

For wireless battery-operated devices (like asset trackers on shipping containers), power consumption is the most critical metric.

Bosch Sensortec (BMI Series, e.g., BMI270)

Strength: Ultra-low power consumption and integrated "smart" features (like built-in step counting or gesture recognition on the chip itself).

Current Consumption: < 150 µA in high-performance mode.

Package: LGA-14 (2.5 x 3.0 mm).

STMicroelectronics (LSM Series, e.g., LSM6DSO)

Strength: High precision and stability. Excellent FIFO (First-In-First-Out) buffer sizes, allowing the main processor to sleep longer while the sensor collects data.

Current Consumption: ~0.55 mA (High Performance).

Package: LGA-14 (2.5 x 3.0 mm) - Often footprint compatible with Bosch, making cross-referencing easier!

Honeywell vs. TE Connectivity

The Battle for Board Mount Pressure Sensors

When lives depend on accuracy (e.g., in ventilators or dialysis machines), generic sensors are not an option.

Honeywell (TruStability™ HSC Series)

Type: Piezoresistive Silicon.

Accuracy: Industry-leading ±0.25% FSS (Full Scale Span) Total Error Band.

Feature: Extensive options for "Gel-coating" to protect the sensor die from moisture and condensation.

Why Buy: The gold standard for stability over time.

TE Connectivity (MS58xx Series)

Type: High-resolution Altimeters/Pressure sensors.

Resolution: Capable of detecting altitude changes as small as 10cm.

Feature: Metal lid options for better EMI protection and waterproofing (O-ring mountable).

Why Buy: Often more cost-effective for high-volume applications that still require high precision.

Pro Tip for Buyers:

When you see a "Stockout" notice on a Honeywell HSC sensor, do not panic. Check the TE Connectivity datasheet. In many board mount pressure sensor applications, these brands can be functionally equivalent if you verify the pinout and communication protocol (I2C/SPI) with your engineering team.

The Power of the Cross Reference Guide

What happens when the specific brand you need is truly unavailable worldwide? This is where the sensor cross reference guide becomes your most powerful tool.

A cross-reference guide allows you to identify alternative parts that are functionally identical or sufficiently similar to the original component. This is a critical workflow for mitigating supply chain disruptions.

How to Use a Cross Reference Strategy Effectively:

Pin-to-Pin Compatibility: The most important factor. Does the alternative sensor fit on the existing PCB pads?

Electrical Characteristics: Check the supply voltage and power consumption. A sensor that uses more power might drain a battery-operated device too quickly.

Software Drivers: Ensure that the communication protocol (e.g., I2C address) is compatible with your current firmware.

Many buyers overlook this step because it requires technical verification. However, a knowledgeable sensor electronic components distributor can assist in this process. We often help clients find "drop-in" replacements that save production lines from stalling.

Wholesale and Bulk Purchasing Strategies

For large-scale manufacturing, purchasing single units is not an option. You need wholesale sensor modules supplied on tape-and-reel for automated assembly.

Moving from spot-buying to wholesale procurement requires a partner who understands volume pricing and logistics.

Economies of Scale: Buying wholesale sensor modules significantly reduces the per-unit cost.

Batch Consistency: Wholesale orders usually come from a single manufacturing lot, ensuring consistent performance across all your devices.

Scheduled Delivery: Professional distributors can hold inventory for you and ship it according to your production schedule.

If you are preparing a large production run, utilizing a wholesale sensor modules strategy is the best way to secure your margin.

Why Joydo Distributors is Your Ideal Partner

In a market defined by the sensor chip shortage and rapid technological change, you need more than a vendor. You need a partner.

Joydo Distributors stands out in the crowded field of electronic component distribution for several key reasons:

A Massive Inventory of Sensors

We have curated one of the most comprehensive inventories in the industry. From standard PCB mount sensors to specialized industrial modules, our stock is real and ready to ship. We understand that in your business, time is money.

Expertise in Hard-to-Find Parts

We excel where others fail. If you need an obsolete sensor components supplier, our sourcing team has the global reach to locate the unfindable. We turn supply chain dead ends into opportunities.

Quality Assurance

We know that industrial sensor procurement allows no room for error. A counterfeit sensor can cause a catastrophic failure in an industrial machine. That is why we implement rigorous quality control measures to ensure every chip we ship is authentic and meets the manufacturer’s specifications.

Example: "At Joydo, we perform Heated Chemical Testing (HCT) to verify the top coating of the chip matches the manufacturer's original specification, ensuring no black-topping has occurred..."

The Joydo Zero-Risk Promise: Our 10-Point Inspection Protocol

In an era where the sensor chip shortage has flooded the market with sub-standard and counterfeit parts, trust is not given; it is earned. At Joydo Distributors, we do not simply move boxes from one warehouse to another. We act as a firewall, protecting your production line from the risks of the open market.

Whether we are sourcing a brand-new PCB mount sensor or locating an obsolete sensor components supplier, every single component must pass our rigorous 10-Point Inspection Process before it ships to your facility. Here is precisely how we guarantee authenticity:

Inbound Logistics & Documentation Verification

The process begins before the box is even opened. Our compliance team verifies the shipping documents, Certificate of Conformance (CoC), and manufacturing traceability. We cross-reference the shipping labels with known manufacturer formats (e.g., verifying that the font and barcode symbology of a "Bosch" label match the official Bosch standard).

External Visual Inspection (Microscope)

Our inspectors use high-power magnification (30x - 100x) to examine the component body. We look for sanding marks, inconsistent texture, or "blacktopping"—a technique where counterfeiters paint over old parts to hide the original markings. The leads are inspected for signs of oxidation, bending, or prior solder tinning, which would indicate a pulled or used part.

Solvent Resistance Testing for Remarking

Counterfeiters often reprint part numbers using low-quality ink. We perform a resistance test using specific solvents (like Acetone or Mineral Spirits) mixed with distinct swabbing techniques. If the ink smears or comes off, or if the surface coating dissolves to reveal a different part number underneath, the lot is immediately rejected.

Dimensions & Mechanical Verification

Precision is key for PCB mount sensors. We use calibrated digital calipers and micrometers to measure the package dimensions, lead pitch, and body thickness. These measurements are compared strictly against the original manufacturer’s datasheet. Even a deviation of 0.1mm can indicate a fake package or a wrong mold.

X-Ray Fluorescence (XRF) Analysis

We use XRF spectroscopy to determine the elemental composition of the component. This serves two purposes: first, to ensure compliance with RoHS (Restriction of Hazardous Substances) directives; and second, to verify that the lead frame material matches the manufacturer's specified alloy (e.g., checking for the correct Tin/Lead ratio).

Non-Destructive X-Ray Testing

This is one of the most critical steps for detecting "empty" packages or incorrect die. By X-raying the sensor, we can look inside the black epoxy resin. We inspect the wire bonding diagrams, the die size, and the lead frame structure. We compare these X-ray images against a "Golden Sample" (a known authentic part) to ensure the internal architecture is identical.

Solderability Testing

A sensor is useless if it cannot be soldered to your board. We perform wetting balance tests to ensure the termination leads are fresh and will accept solder during your reflow process. This is particularly important for obsolete sensor components that may have been sitting in storage for several years.

Heated Chemical Test (HCT)

Some advanced counterfeits use high-quality epoxy that resists standard acetone. For these, we employ Heated Chemical Testing. By heating a specialized solvent, we can strip away the top layer of the component's surface. This exposes the original texture of the mold compound, revealing if the surface has been resurfaced or tampered with.

Decapsulation (Decap) Analysis

For high-value orders, we perform destructive testing on a sample unit. We use acid to dissolve the package completely, exposing the silicon die inside. We then use a high-power metallurgical microscope to read the markings directly on the silicon wafer. We confirm the manufacturer's logo, the copyright year, and the die part number code to ensure it matches the external label.

Electrical Functional Testing

Finally, for specific sensors where we have test fixtures available, we perform functional testing. We verify that the sensor powers up within the specified voltage range and outputs the correct signal (e.g., verifying an I2C response from a pressure sensor). This is the ultimate proof that the component is not just a piece of plastic, but a working device.

Only when a component passes this gauntlet do we release it from our massive inventory of sensors to be shipped to you.

Conclusion

The landscape of electronics manufacturing is shifting. The demand for industrial sensors will only continue to grow as the world becomes more automated and connected. For procurement managers, this means the challenge of sourcing high-quality components will remain a priority.

By understanding the nuances of the market—from leveraging sensor cross reference guide strategies to partnering with a distributor that holds a massive inventory of sensors—you can insulate your company from market volatility.

Whether you are looking to buy Bosch MEMS sensors online for a new prototype or need a reliable partner for volume wholesale sensor modules, the solution lies in working with experts who understand the supply chain.

Do not let shortages dictate your production schedule. Upload your BOM to Joydo Distributors today. Let us help you find the sensor chip shortage solutions that will keep your factory running and your business growing.